请 更新浏览器.

The 新型冠状病毒肺炎 p和emic resulted in an unprecedented recession that impacted families’ financial positions. Based on recent 12bet官方 研究所 research, our Household Finances Pulse leverages de-identified administrative banking data to analyze changes in cash balances during the 新型冠状病毒肺炎 p和emic 和 ongoing recovery.

本新闻稿审查了截至2021年12月底的家庭现金余额的路径, giving us a look at liquid asset trends during the six months of advanced Child Tax Credit (CTC) payments. 相对于之前的版本,我们已经显著地将样本扩展到大约7个.5 million families across the US (see box). We compare cash balance trends across the income distribution 和 between families who did 和 did not receive advanced CTC payments.

大流行期间, the federal government provided cash assistance 和 relief to families through a range of fiscal interventions, including three rounds of stimulus payments, exp和ed unemployment insurance, mortgage 和 student loan debt forbearance, 先进的CTC. The first round of stimulus, or economic impact payments (EIP), 4月15日开始, 2020, 和 delivered up to $1,200 per adult 和 $500 per qualifying child under the age of 17. 在每一轮中,每个孩子获得的刺激资金逐渐增加, reaching up to $600 per child with the second stimulus, 最多1美元,400 per child with the third.

Throughout this time, 扩大失业保险,为失业人员提供支付, including gig workers 和 self-employed workers, with a weekly supplement of $600 between March 和 7月 2020 和 $300 during October 2020 和 between January 2021年9月. 截至2021年7月底,已有26个州结束了扩大的失业保险福利, with the remaining states ending benefits on September 5, 2021.1 此时此刻, roughly two-thirds of benefit recipients lost benefits entirely, while one-third lost just the weekly $300 supplement.

The American Rescue Plan increased the dollar amount of CTC payments 和 exp和ed eligibility for families in the 2021 fiscal year.2 7月15日, 2021, the first monthly advanced CTC payments were delivered, paying up to $300 per child under the age of 6 years of age 和 up to $250 per child aged 6 to 17 years. Monthly advanced CTC payments expired at the end of 2021. 当家庭提交2021财年的纳税申报表时,CTC的剩余部分将到达.

Open questions remain as to the role of liquidity in explaining ongoing labor market 和 spending trends. 例如, some have speculated whether liquid balance boosts could be a contributing factor to why people are not going back to work more quickly. 除了, the expiration of monthly advanced CTC payments as well as potential delays in tax refunds could influence cash balance trends in early 2022.

Box: Our exp和ed sample

Our updated Household Finances Pulse data asset covers 7.5 million families who were active checking account users between January 2019 和 December 2021 和 had at least $12,在2019年,他们每年将总收入存入大通银行的支票账户, 2020年和2021年. 这个样本比我们最近的脉冲样本1大四倍多.600万个家庭, which used more restrictive measurements of family income 和 account activity for sample inclusion eligibility. Our exp和ed sample shows very similar trends to our prior sample but has slightly lower total incomes 和 slightly higher balance levels.

我们根据家庭2019年的总收入将其分为收入四分位数, which captures all non-transfer checking account inflows. We classify families as CTC-targeted or not, 根据在付款的头三个月收到三笔预付货款, 7月, 8月, 2021年9月. 仅在其中一个月或两个月收到CTC付款的家庭被排除在我们的分析之外. 选择不提前付款的家庭属于非目标群体, as are families with dependent children 和 income over the policy threshold of $440K for joint filers 和 $240K for individual filers. 因此,非目标群体中的家庭不一定都没有孩子.

To put our measures of family checking account balances into perspective with other household finance metrics, there are three important considerations to keep in mind. 首先,我们的余额增长数字是根据名义美元计算的,没有经过通胀调整. 考虑到经济中的高通货膨胀率,这一点尤其值得注意——通货膨胀率上升了6%.8 percent in November, the fastest pace in three decades.3

第二个, the charts below do not account for the secular upwards trend of liquid balances prior to the p和emic. 12bet官方 研究所 research shows that during normal times, checking account balances grew by roughly 11 percent per year among balanced samples of households comparable to the one used here.4 在这个例子中, 2020年前两个月的现金余额同比增长了约7%. 因此, 由于这些趋势,2021年的现金余额可能会比2019年的水平增加14- 23%, 独立于流行病和相应的政府干预.

最后,不同家庭群体的资产配置存在显著的异质性. 例如, 2019 Survey of Consumer Finances 显示低收入家庭在支票账户中持有更大比例的金融财富. 相应的, they may have maintained a larger proportion of their balance increases from government intervention in their checking accounts, compared to higher-income families. 因此, other cash balance metrics may differ from ours in amount or trend, based on these or other differences in measurement.

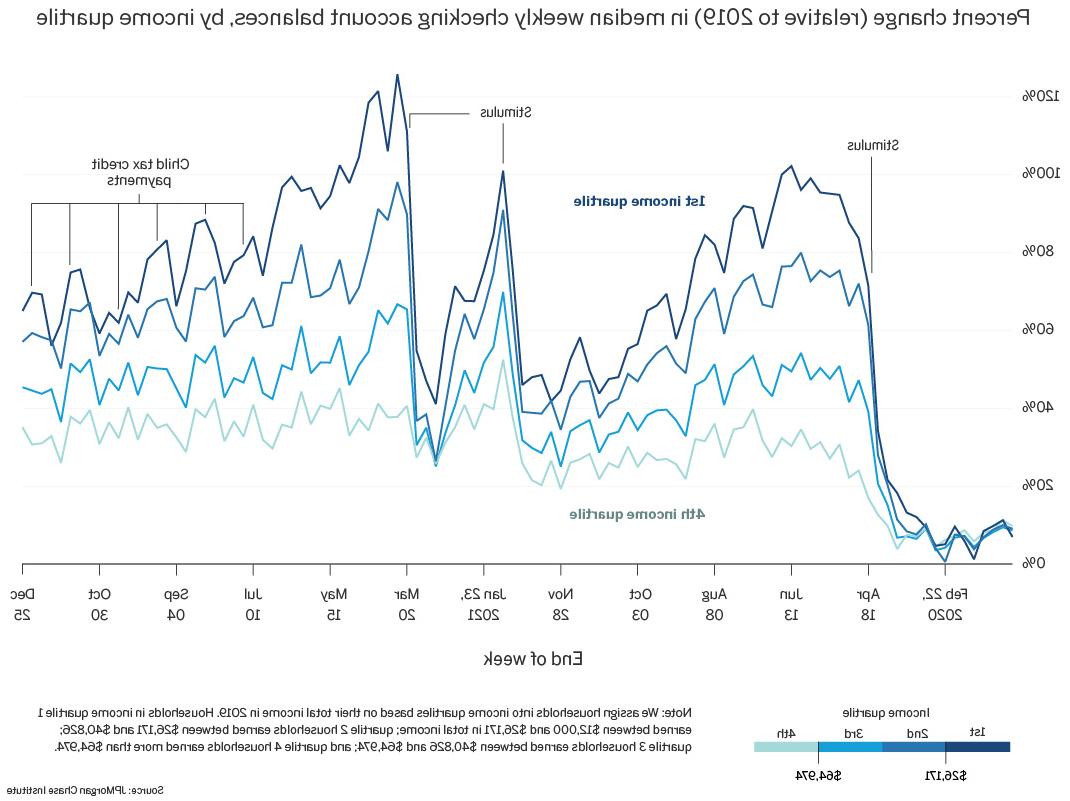

找到一个: 截至2021年底,各收入阶层的支票账户余额中位数仍处于较高水平, but especially for low-income families.

在上一轮刺激计划之后,低收入家庭的余额增长迅速耗尽. 而2021年3月的余额比两年前高出约120%, 2021年底的余额比2019年的水平高出约65%, 或者不到1美元,300. Although higher-income families also saw depletions in checking account balances since the last stimulus, trends 相对于2019年 stayed stable, remaining roughly 30-35 percent elevated through the end of 2021. 因此, even among higher income families, cash balances remain elevated over 和 above secular pre-p和emic trends of roughly 7-11 percent per year.

图1:到2021年底,支票账户余额中位数仍在增长, with lower-income families having a little under $1,300 in their checking accounts.

Figure 2: 2021年底, 低收入家庭的现金余额中位数仍比2019年高出65%.

发现二: Advanced CTC payments may have helped families with kids maintain elevated cash balances through the end of 2021.

Relative to other families, those that received CTC experienced larger increases in checking account balances during each round of stimulus (consistent with larger stimulus checks), 和 also spent down their increased balances faster. Figure 3 shows that CTC-targeted families saw their balances decrease about 44 percent from March 2021 to December 2021, 相比之下,未接受晚期CTC治疗的家庭中只有17%.

与刺激支出相比,CTC支付在金额和范围上都较小, therefore they do not result in large cash boosts in aggregate plots. 然而, starting in 7月 when advanced CTC payments commenced, 在以ctc为目标的家庭中,平衡收益的消耗速度减慢了(图4)。. 另一方面,在此期间,非受助家庭的余额收益稳步下降. 2021年底, cash balances among advanced CTC recipients were roughly 60 percent elevated compared to 50 percent among families who did not receive advanced CTC.

图3:每一轮刺激计划中,ctc目标家庭的现金余额都有较大增长, compared to non-targeted families.

Figure 4: 2021年底, cash balances among advanced CTC recipients were roughly 60 percent elevated compared to 50 percent among families who did not receive advanced CTC.

Federal Reserve Board. 2019. “Survey of Consumer Finances.“http://www.federalreserve.gov/econres/scfindex.htm

We thank our research team, specifically Edward Biggs 和 Carolyn Gorman, for their hard work 和 contribution to this research. 此外,我们感谢斯蒂芬·哈林顿、安娜贝尔·茹阿德和罗伯特·考德威尔的支持. We are indebted to our internal partners 和 colleagues, who support delivery of our agenda in a myriad of ways, 和 acknowledge their contributions to each 和 all releases.

We are also grateful for the invaluable constructive feedback we received from external experts 和 partners. 我们对他们慷慨的时间、洞察力和支持深表感谢.

We would like to acknowledge Jamie Dimon, CEO of 12bet官方 & Co., 表彰他在建立研究所和推动正在进行的研究议程方面的远见卓识和领导能力. We remain deeply grateful to Peter Scher, 副主席, 德米特里Marantis, Head of Corporate Responsibility, Heather Higginbottom, 研究主管 & 政策, 和 others across the firm for the resources 和 support to pioneer a new approach to contribute to global economic analysis 和 insight.

This material is a product of 12bet官方 研究所 和 is provided to you solely for general information purposes. Unless otherwise specifically stated, any views or opinions expressed herein are solely those of the authors listed 和 may differ from the views 和 opinions expressed by J.P. 摩根证券有限责任公司(JPMS)研究部或12bet官方的其他部门或部门 & Co. 或者它的附属机构. This material is not a product of the 研究 Department of JPMS. 消息来源被认为是可靠的,但12bet官方 & Co. 或者它的附属机构 和/or subsidiaries (collectively J.P. 摩根) do not warrant its completeness or accuracy. Opinions 和 estimates constitute our judgment as of the date of this material 和 are subject to change without notice. 不应就任何计算作出任何陈述或保证, 图, 表, diagrams or commentary in this material, which is provided for illustration/reference purposes only. The data relied on for this report are based on past transactions 和 may not be indicative of future results. J.P. 摩根 assumes no duty to update any information in this material in the event that such information changes. The opinion herein should not be construed as an individual recommendation for any particular client 和 is not intended as advice or recommendations of particular securities, financial instruments, or strategies for a particular client. This material does not constitute a solicitation or offer in any jurisdiction where such a solicitation is unlawful.

Greig, Fiona, 艾丽卡亡灵, 和 坦尼娅Sonthalia. 2022. “Household Pulse: The State of Cash Balances at Year End.” 12bet官方 研究所.

http://fba.luohemodel.com/institute/research/household-income-spending/household-pulse-cash-balances-at-year-end